Chicago company to pay $11 million for doing business with sanctioned Russian oligarch

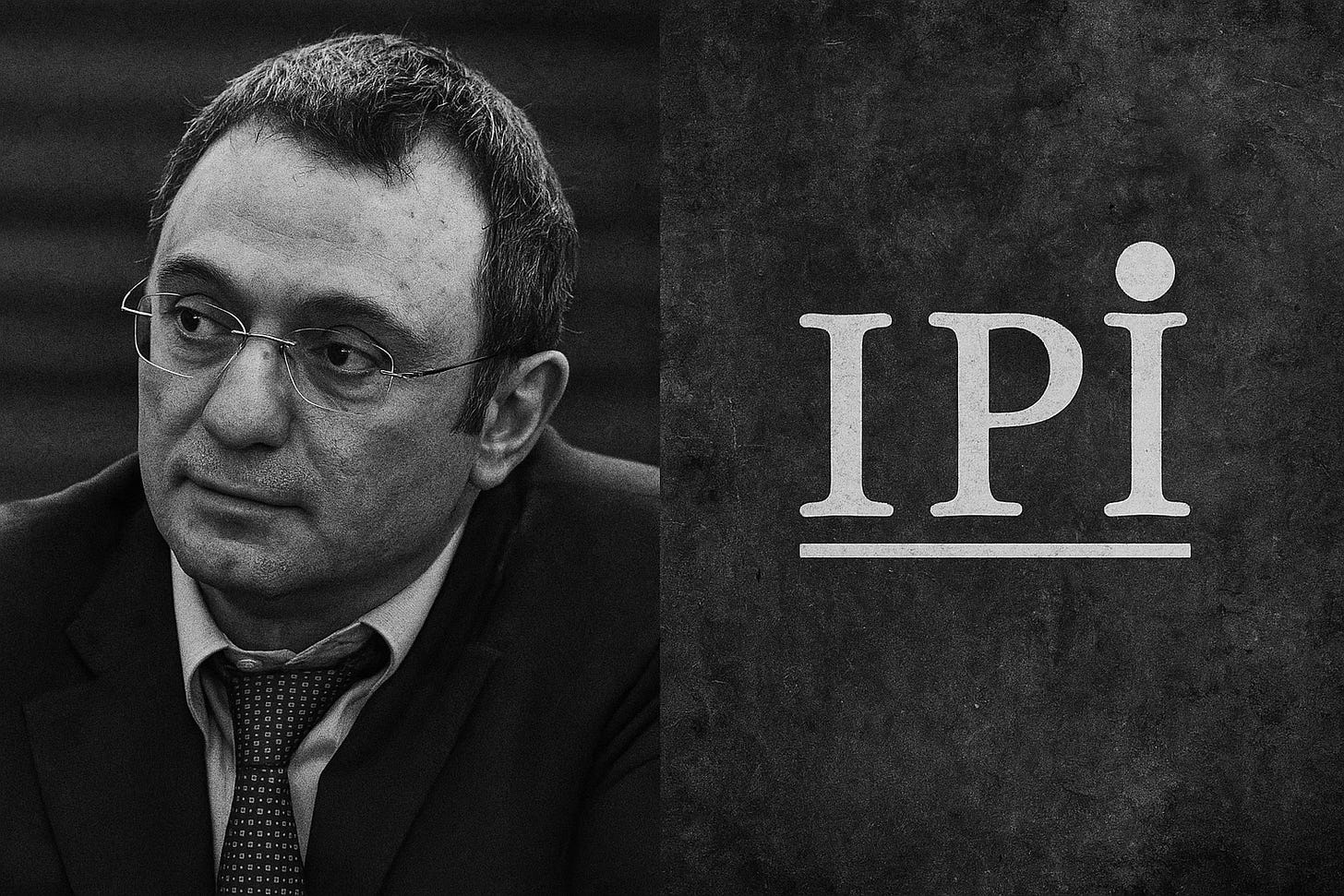

The settlement is far less than the $50 million U.S. officials say IPI Partners took from close Putin ally Suleiman Kerimov.

A Chicago-based private equity firm is expected to pay an $11 million settlement after facing accusations of violating U.S. sanctions law by doing business with a Russian oligarch, according to an advisory from the Treasury Department issued on Tuesday.

IPI Partners, which invests in and operates data centers, will hand over $11.49 million for allegedly receiving investments linked to sanctioned Russian billionaire Suleiman Kerimov.

Kerimov maintains close ties with Russian President Vladimir Putin and was formerly associated with brutal Moscow-backed Chechen warlord Ramzan Kadyrov. The two have since had a falling out, according to The Moscow Times.

For his relationship with the Kremlin, the U.S. government slapped sanctions on Kerimov in April 2018 under an Obama-era program designed to economically punish Russia for its initial invasion of Ukraine’s Crimean Peninsula in 2014. This action barred American companies from conducting business with Kerimov, either directly or indirectly.

However, according to federal regulators, IPI arranged and accepted $50 million in investments during 2017 and 2018 from Definition, a British Virgin Islands-based entity connected to the Kerimov family. Officials say IPI continued this financial relationship with the company several years after Kerimov’s designation on the sanctions list. IPI also allegedly sought outside legal advice to manage the situation.

In announcing the federal government’s settlement with IPI, regulators with the Treasury Department said the American company’s violations were not “egregious.” In assessing the penalty, officials cited mitigating factors such as IPI’s lack of prior sanctions violations, alongside aggravating factors including the firm’s prior knowledge that Kerimov was the original source of the funds and its continued involvement after sanctions were imposed.

U.S. officials also underscored the compliance risks faced by private equity firms when dealing with complex ownership structures that may obscure sanctioned individuals’ interests.